Tax Cuts: The Historical Evolution of Lower Tax Policies

Part 1

The concept of taxation has been intertwined with government since ancient times, but the push for lower taxes as a deliberate economic strategy emerged prominently in modern history, particularly in the United States and Western economies. In the early days of the American republic, taxes were minimal, reflecting a libertarian ethos rooted in resistance to British overreach. The U.S. Constitution initially limited federal taxation to tariffs and excises, with no income tax until the Civil War era. The first federal income tax in 1861 was a temporary wartime measure, starting at 3% on incomes over $800, but it was repealed in 1872.

This low-tax environment fostered rapid industrialization and innovation in the late 19th century, as entrepreneurs faced few fiscal barriers. The 20th century marked a shift toward higher taxes, driven by world wars and expanding government roles. The 16th Amendment in 1913 permanently established the federal income tax, with initial top rates at 7%. However, during World War I and II, rates skyrocketed—peaking at 94% in 1944 on incomes over $200,000.

Post-war, these high rates persisted under the guise of funding social programs, but economists began arguing they stifled growth. The 1920s saw a brief experiment with tax cuts under Presidents Harding and Coolidge, reducing top rates from 73% to 25%, which coincided with the Roaring Twenties' economic boom.

Revenue actually increased due to heightened economic activity, a precursor to later supply-side theories. The mid-20th century's high-tax regime, with top marginal rates over 90% in the 1950s, came under fire from free-market thinkers.

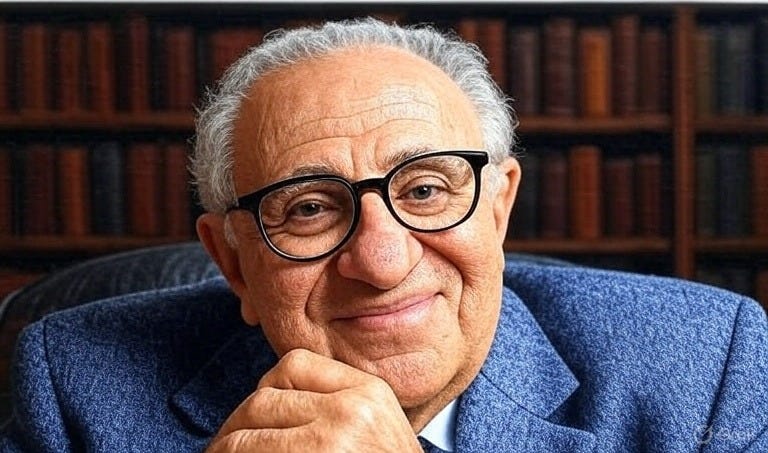

Milton Friedman, a Nobel laureate economist, critiqued this, stating,

"I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it's possible."

Friedman argued that high taxes distorted incentives, reducing productivity and innovation. This view gained traction in the 1970s amid stagflation, leading to the Economic Recovery Tax Act of 1981 under President Ronald Reagan. Reagan slashed top individual rates from 70% to 50%, and later to 28% in 1986, emphasizing supply-side economics. He famously quipped, "Government's view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it."

Globally, similar patterns emerged. In the UK, post-WWII taxes reached punitive levels, but Margaret Thatcher's cuts in the 1980s mirrored Reagan's, spurring growth. Murray Rothbard, a libertarian philosopher, viewed taxes as coercive, writing, "Taxation is theft, purely and simply even though it is theft on a grand and colossal scale."

More recent U.S. examples include the 2001-2003 Bush tax cuts and the 2017 Tax Cuts and Jobs Act under Trump, which lowered corporate rates from 35% to 21%, boosting investment.

These policies reflect a historical lesson: lower taxes correlate with expansions, as seen in the 1920s, 1980s, and post-2017 recoveries, where GDP growth accelerated and unemployment fell.

Conversely, high-tax eras like the 1930s Depression prolonged stagnation. This history underscores that reducing fiscal burdens unleashes human potential, driving prosperity through voluntary exchange rather than state extraction.

Laws need to be passed that if federal taxes no 1 else can.If states tax counties/cities can’t! It’s stealing all around & we never agreed to pay taxes. We were born & have no say so.100% extortion! If a person lives in the city look how much $ they steal from people from the fed down.ITS WRONG & AGAINST CIVIL RIGHTS. Who are they to sit up in Jackson making rules on people to hand over their hard earned $??

Taxes fund things the government has no right in which to be involved. Yes, I agree, a lot of the programs are helpful and needed, but they should be funded by private corporations AND voluntary participating individuals. The government takes our money and funds things without our consent, many which I do not agree with; this is theft in my opinion!